The development and changes of the coating tool market from the acquisition cases at the end of 2020

At the end of 2020, the news of the acquisition of the painting tool brand - WORK TOOLS by the American paint giantBEHRhas brought attention to the sub-industry of painting tools. Cases of paint tool brands being acquired by paint giants have emerged in recent years.

It has become a trending acquisition in the coatings industry. For example, SHERWIN-WILLIAMS acquired the century-old American paint brushes brand PURDY, and the Norwegian paint company ORKLAacquired the brush tool brands: ANZA, HARRIS…etc.

Why do the coating giants favor this small coating tool market? Let's start from the acquisition topic, introduce the market share, development potential, and comparison of the current situation of the Chinese and foreign coating tools industry, and make a simple analysis.

Paint and paint tools are a family, and they are basically inseparable. Good paint should be equipped with good tools. This has been the consensus of paint giants and high-end paint users. Good paint tools can avoid wasting expensive paint, improve painting efficiency and surface beauty, and good tools have more. Durable, lint-free, easy to clean, reusable, and more environmentally friendly.

Therefore, these well-known paint brands have also been looking for good tools to use with their paints, or to sell them together to consumers, and use tools to increase paint sales and provide users with better services.

Paint Tools/Coating Tools/Home Decoration Tools

Sherwin-Williams has more than 4,000 paint stores in the United States. While selling their own paints, they directly match the characteristics of different paints, and display the corresponding tools and paints in the store for packaging and sales, so that consumers do not need to be in the tool. The choice is time-consuming. Such strategies are welcomed by consumers.

For these paint giants with annual sales of tens of billions of dollars, instead of spending time and energy developing paint tools, it is better to directly acquire a tool brand. For paint giants, the acquisition of tool brands is worse than the acquisition of other paint companies or competitors. The cost and risk are much lower, and they take relatively little time to prepare and make decisions.

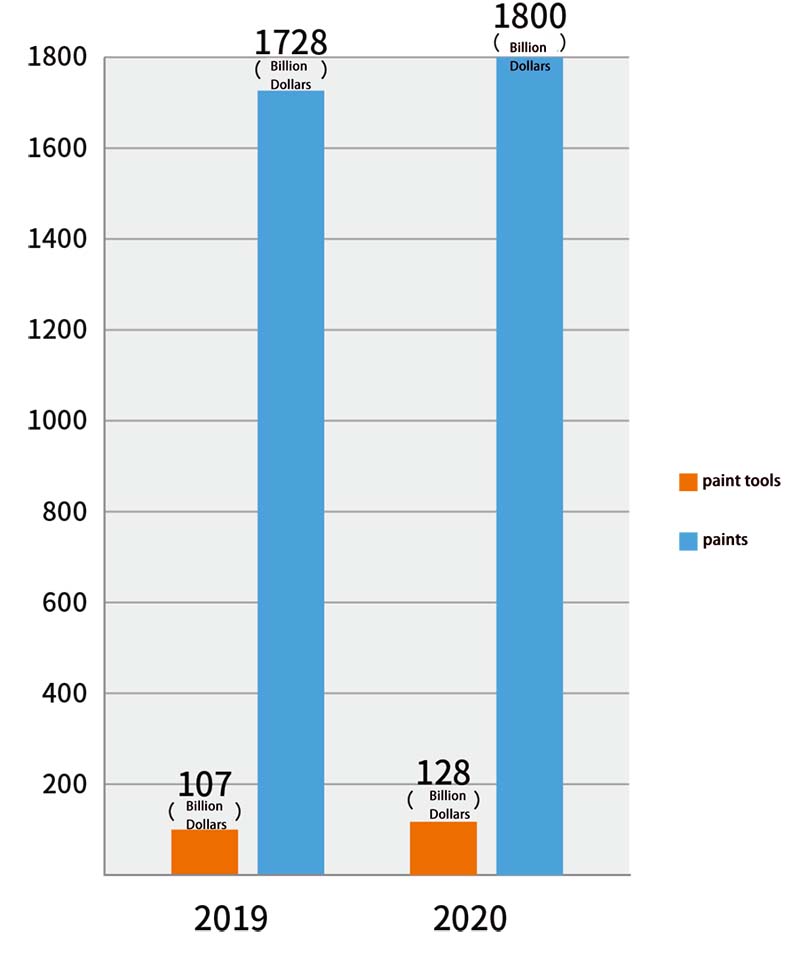

The market potential of painting tools is great. Although the market volume of painting tools is quite different from that of coatings, it still has great potential for development. According to the data of the Global Coatings Industry Association (WPCIA), in 2019, The total sales of the global coatings market is 172.8 billion US dollars, and it is expected to be 180 billion US dollars in 2020. Among them, architectural coatings account for more than 53%, nearly 90 billion US dollars. Architectural coatings are also the most widely used places for painting tools. Mounting tools are used in the construction industry.

Looking at the painting tool market, according to data provided by GMI Consulting, the global sales of painting tools in 2019 were $10.7 billion. This statistic includes the sales of the following products: brushes, rollers, scrapers, putty knives, pallet paint buckets, telescopic rods, textured paper, sanding tools, airbrushes, etc. In 2020, it is expected that the total sales of such products will reach 12.8 billion US dollars, an increase of at least 20% compared with 2019. There are factors that have caused a substantial increase in demand caused by the impact of the epidemic.

In this way, the sales ratio of tools and coatings is 1:14, and from the sales data in recent years, the growth rate of the coating tools business is faster than that of the coatings business. It is expected that from 2021 to 2025, the demand for painting tools will maintain an average annual growth rate of more than 6%, which is higher than the growth rate of the coatings business.

Especially in the Asia-Pacific region, the construction industry is still in the growth stage and has greater potential than the traditional European and American markets. This potential should also be another reason why the paint giant is optimistic and acquires the tool brand?

Let's take a look inside the field of painting tools: According to GMI data, in 2019's global sales of 10.7 billion US dollars, brushes are the most widely used painting tools, accounting for 20%, about 2.2 billion US dollars, Among the acquired companies mentioned above, PURDY, HARRIS, and ANZA are all based on brush business. Other representative companies NOUR, NESPOLI.

Paint Rollers: Including roller racks, wool covers, and combinations, accounting for 25%, about 2.7 billion US dollars. As mentioned at the beginning, WORK TOOLS is mainly based on the roller business, and other representative companies areLINZER, BENNETT, WOOSTER. It can be seen that brush rollers are the two most important types of painting tools, accounting for 45% of the business volume. Most of the companies that operate brushing tools also basically take these two types of products as their core business.

Masking products 8% Representative companies: 3M, SHUR-TAPE;

15% of spray guns Representative companies: WAGNER;

Scraper putty knife 5% Representative companies: HYDE, ALLWAY TOOLS, A.RICHARD;

Telescopic rod 5% Representative companies: WOOSTER, MR, LONGARM;

Pallets: 4%

Paint tools accessories: 18%

Based on the above data, the entire coating tool industry, with a global share of 12.8 billion US dollars, is indeed small compared to other large industries, but it is not small in the subdivision field, even if it only achieves a global share of 1%, There are also more than 100 million US dollars in sales.

This industry is relatively easy to get started with, with many participants and very scattered, especially in China. According to rough statistics, there are factories and companies engaged in painting tools in Jiangsu/Zhejiang/Shanghai/Guangdong/Anhui/Shandong/Hebei and other regions.

There are more than 1,000 companies, the largest in the world in terms of number of companies, but in terms of quality, comprehensive strength, and scale, we can't even name a few Chinese companies. 95% of the companies have an annual business volume of less than 100 million yuan, and 80% of the companies have The annual business volume is less than RMB 50 million, and there are very few that can compete head-on with international giants.

Because it still takes a lot of energy and patience to do deep and refined work in this industry, this industry has certain particularities and is closely related to the paint industry. It is necessary to have an in-depth understanding of, and even mastery of, plastic, metal and other craftsmanship. Some hand tools once told our paint tools colleagues, "We originally thought that hand tools were complicated enough, but we didn't expect brushes and roller tools to be more complicated than hand tools. It is several times more complicated!

At present, in this niche industry, the first echelon are the industry giants from Europe, America and Japan, such as Otsuka in Japan, WOOSTER in the United States, NESPOLI and STORCH in Europe. They are characterized by a long history, rooted in this small industry, and insist on being sophisticated and deep. Some companies have been doing it for more than 100 years, especially European and American companies.

In fact, they do not have lofty goals and ideals like our Chinese companies, nor have grand visions, nor the determination to fight for the first to kill their opponents. They simply love their products and work, and use the defense of quality as their own. Their dignity and bottom line, they only have one goal: to make excellent products, solve users' pain points, and provide users with lifetime value. These are worthy of our Chinese companies to learn and think about.

The gap is huge, but we must also see the potential and progress of Chinese companies. In recent years, although domestic companies have faced rising costs, difficulty in recruiting, and unfavorable factors such as exchange rates and trade wars, it is precisely because of these unfavorable factors that Many paint tools companies in China have learned to seek development in difficult situations.

They improved production technology and automation, improved management capabilities, and increased investment in product development, and a number of outstanding companies have emerged one after another. And G.SB PAINT TOOLS CO., LTD. is one of the best.

We also believe that in the near future, China will also have a number of outstanding companies in the painting tool industry, becoming the "little giants" in this segment!

Our customers are mainly from North America, Europe, Australia, New Zealand, Chinese Taipei, Hong Kong, Japan and South Korea and other countries and regions, but also involve South America, Southeast Asia, the Middle East and Africa. These customers come from a wide range of building materials retailers, paint manufacturers, supermarkets and agents.

These retailers and sales channels range from homeowners looking to make their first home improvement to self-employed individuals looking to improve their business, and we serve each of their users and businesses in between.

Industry Trends

Paint Rollers Market size surpassed USD 3.1 billion in 2021 and is estimated to grow at over 6.3% CAGR from 2022 to 2028. Rising remodeling and building construction across the globe is driving the industry growth. The industry shipments are predicted to reach 1,183.6 million units by 2028.

Over the past few years, the market has shifted its preference from paintbrushes to rollers and its demand is projected to rise multiple folds. Increasing structural reform plans along with shifting consumer preferences for standardized painting in less time are accelerating the paint rollers market expansion.

Infrastructural expansion is a major factor that will fuel the demand for paint rollers in the construction industry. Socioeconomic developments and housing subsidies by the regional government will positively impact the residential sector. Additionally, the entertainment sector has emerged as a major growth avenue for the paint rollers business.

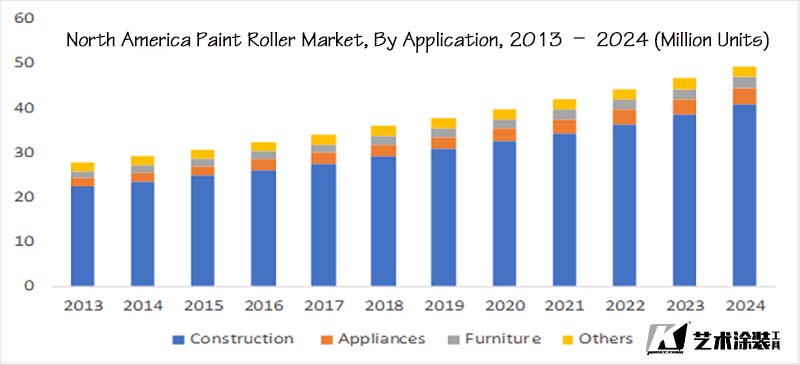

Tips: North America Paint Roller Market, By Application, 2013 – 2024 (Million Units)

North America Paint Rollers Market Size By Type (Woven [Synthetic Woven, Blended Woven], Knit [Synthetic Knit, Blended Knit]), By Fabric (Synthetic [Nylon, Polyester], Blended [Polyester Blend, Wool Blend]), By Pile Depth (Shorter Pile, Medium Pile, High Pile), By Application (Construction [Residential, Commercial], Appliances, Furniture) Country Outlook (U.S., Canada), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2017 – 2024

North America Paint Rollers Market size was valued at USD 334.3 million in 2017 and is expected to witness growth of more than 5.8% CAGR from 2018 to 2024.

Growing demand for residential space coupled with government spending on projects such as roads, telecommunications, housing and railways is expected to drive product demand. In 2016, the U.S. homebuilding industry added 160,000 new buildings (single and multi-site organizations) with total revenue of $420 billion.

Continued growth in the residential construction industry coupled with economic recovery from recessionary pressures will expand the North American paint roller market.

Major players in the region are involved in R&D programs aimed at developing technologies to expand and innovate product lines. The researchers are focusing on improving the commercial viability and end use of the product.

Breakthroughs in design, enhancing the user-friendliness of products, are expected to drive the overall market growth. In addition, market players actively form partnerships with architects and government tenders to supply products in bulk at economical prices.

Another key factor driving the paint roller market is the increasing use of do-it-yourself (DIY) paint roller methods in the United States and Canada. Ease of applicability coupled with competitive pricing of the product is expected to drive the overall market demand. Although the shortage of skilled labor can present a huge challenge for the paint roller industry, especially when it comes to large construction projects on the road.

The recession that hit the construction industry in 2008 led to the migration of skilled labor to other fields. This has a major impact on the paint and coatings workforce, resulting in a significant loss of experience, skills and availability. This lack of skills is likely to negatively impact 28,000 construction projects per year by 2020, hindering market growth in the years to come.

Braided type accounted for 46.3% of the industry share in 2016 and is expected to gain a considerable market share of 48.4% by 2024. The excellent properties of protection, drainage, filtration, separation and reinforcement offered by the product have increased the demand. Enhanced filtration capabilities allow for greater permeability and absorption of fluids, which has led to a high preference for woven paint rollers in several construction projects. Furthermore, the growing demand for eco-friendly and high-performance products will boost the industry growth.

The paint roller market for blended fabrics in North America was 19.0 million units in 2017 and is expected to reach 27.9 million units by 2024, growing at a CAGR of 5.7% from 2018 to 2024. Blended fabrics have unique properties because they are manufactured using two or more different types of fibers to meet specific needs in coating applications. Superior properties, including high textural properties as well as fine finishes in a single coat, drive their demand for construction tasks that require a perfect finish.

The North American paint roller market (shorter pile depth) was 11.3 million units in 2017 and is expected to reach 17 million units by 2024, growing at a CAGR of 6.1%. Shorter pile paint rollers have gained a lot of demand from the automotive industry in recent time frames due to their excellent paint absorption, coverage and flat finish.

Due to their size, shorter pile rollers allow paint to reach hard-to-reach areas. Spare parts coating in the automotive industry is driving the demand for shorter pile coating rollers. Shorter nap rollers also have the greatest application on walls, wood and metal surfaces.

Construction accounts for the largest share of paint roller applications and is expected to exceed $420.2 million by 2024. The economic recovery from the recession has led to a recovery in the residential and commercial construction industries, increasing product demand.

In addition, consumer preference towards eye-catching interiors, especially in the residential segment, further positively impacts product demand

The U.S. had the largest revenue in 2017 at $256.2 million, thanks to a construction boom in recent years. The U.S. residential construction industry is expected to construct 160,000 new buildings, thereby increasing the demand for the paint roller market.

Growing focus on renovations and coatings to protect buildings from wear, chemical attack, and protection from UV rays is another key factor influencing market growth. In addition, numerous government and private organizations in the region have also been investing heavily in infrastructure development, creating lucrative opportunities for manufacturers in the region.

Major industry players operating in the North American paint roller market are Mill Rose, Richard Tools, Hyde tools Inc, Purdy, Gordon Brush, Anderson Products, and Premier Rollers. The market for painting tools in the region is diverse with the participation of several local and multinational companies. Market dynamics are largely influenced by strategic moves by players large and small, including ongoing mergers and acquisitions, collaborations, and supply agreements.

The North American paint roller market is dominated by large manufacturers such as Gordon Brush, Purdy, and T.S. Simms & Co.'s diverse product portfolio, geographic presence, and establishment of effective distribution channels are key factors that enable these players to dominate the market.

Manufacturers also conduct extensive R&D and technological improvements to create innovative products to enhance the user experience. The company has focused on developing cost-cutting technologies to increase its market share and instilling modern technologies to meet market demands.